Why Investing in San Francisco Bay Area is Your Best Option

Fact

The average California homeowner has 83% of their total net worth wrapped up in the equity of their real estate. This means you should start treating your real estate like an investment portfolio.

Data

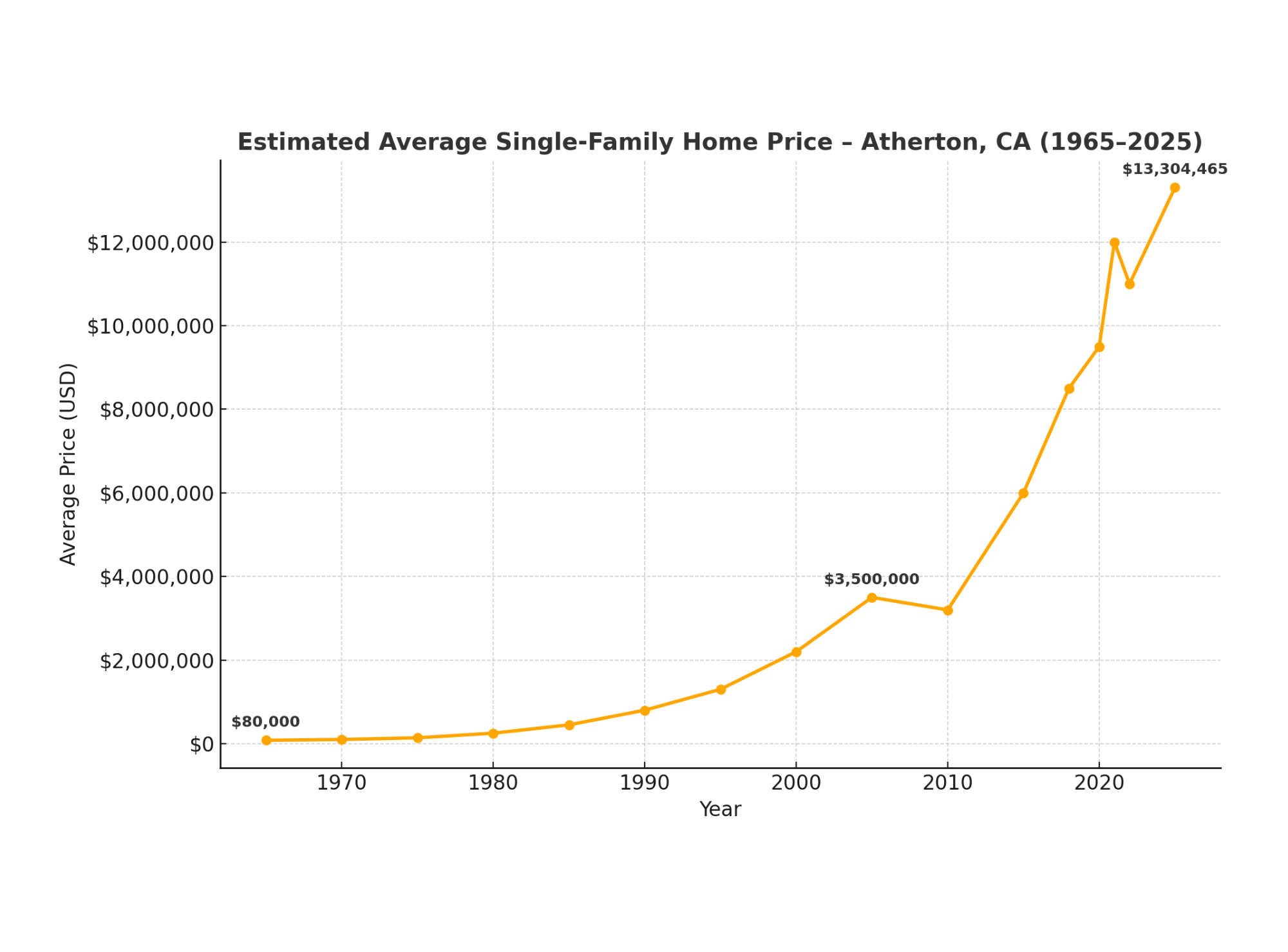

If you invested $80K into Atherton Real Estate in 1965, you’d have 16,530% growth (8.90% per year)

If you invested $80K into the S&P 500 in 1965, you’d have 36,600% growth (10.35% per year)

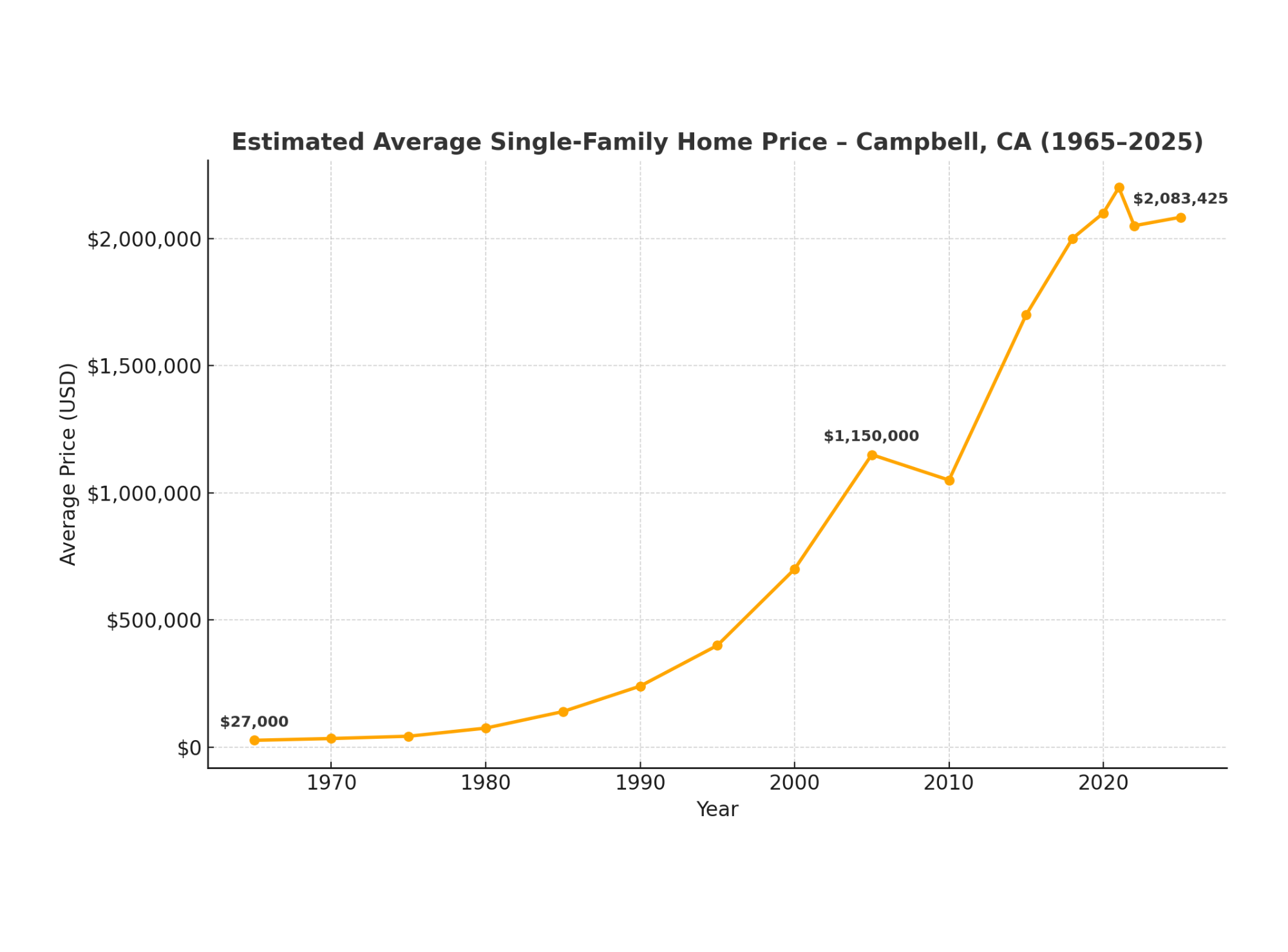

If you invested $27K into Campbell Real Estate in 1965, you’d have 7,616% growth (7.51% per year)

If you invested $27K into the S&P 500 in 1965, you’d have 36,600% growth (10.35% per year)

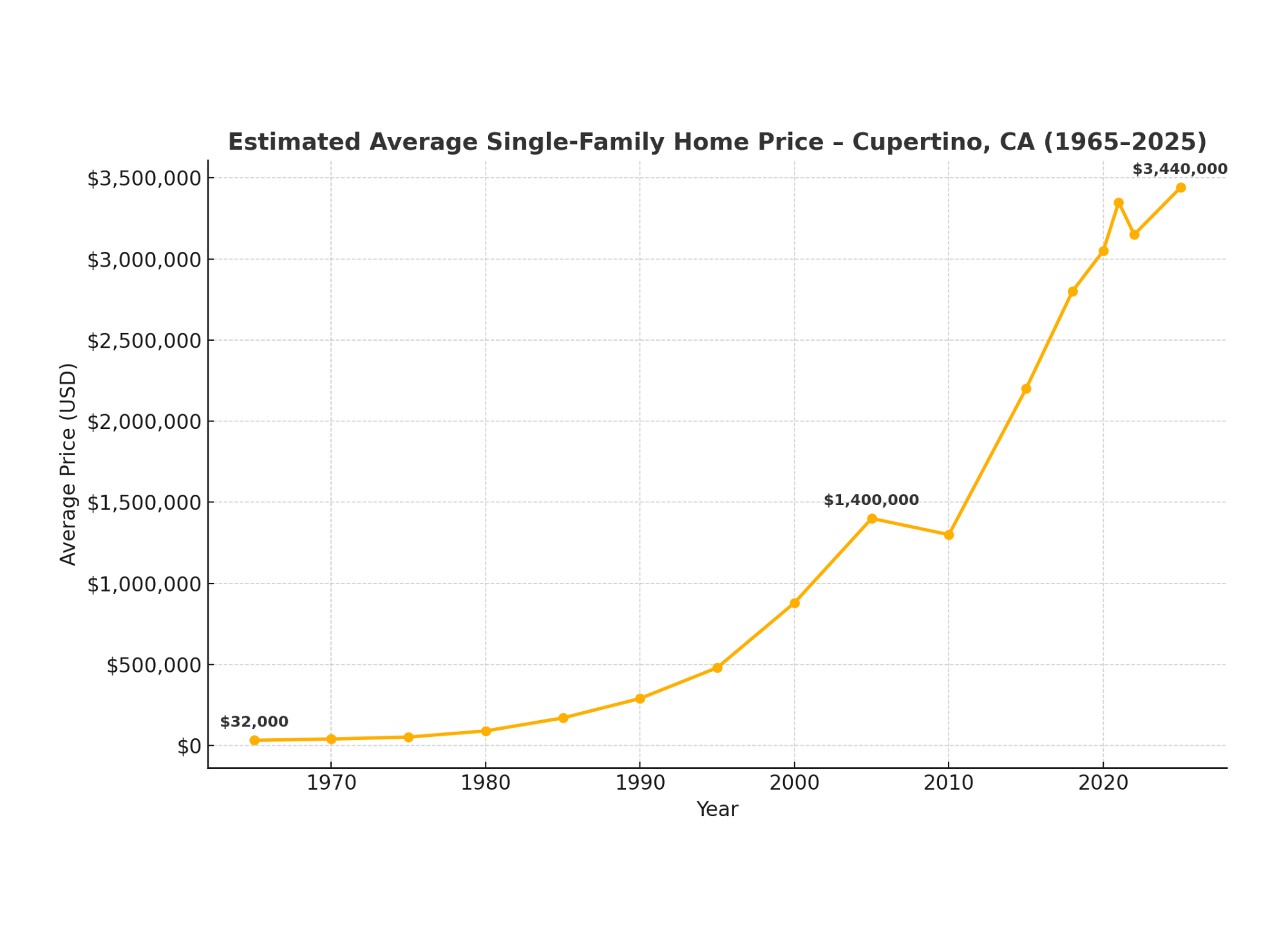

If you invested $32K into Cupertino Real Estate in 1965, you’d have 10,650% growth (8.11% per year)

If you invested $32K into the S&P 500 in 1965, you’d have 36,600% growth (10.35% per year)

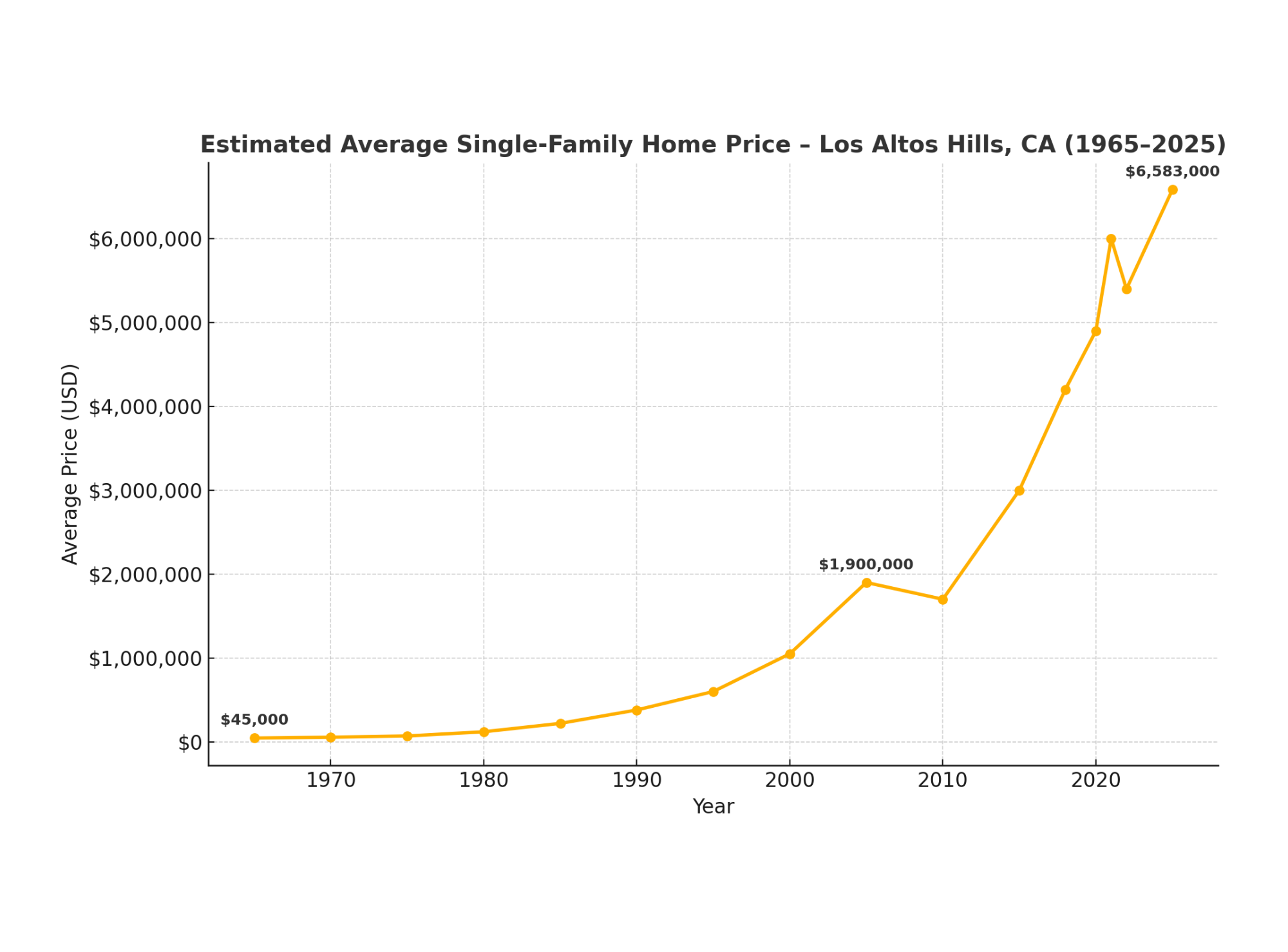

If you invested $45K into Los Altos Hills Real Estate in 1965, you’d have 14,529% growth (8.66% per year)

If you invested $45K into the S&P 500 in 1965, you’d have 36,600% growth (10.35% per year)

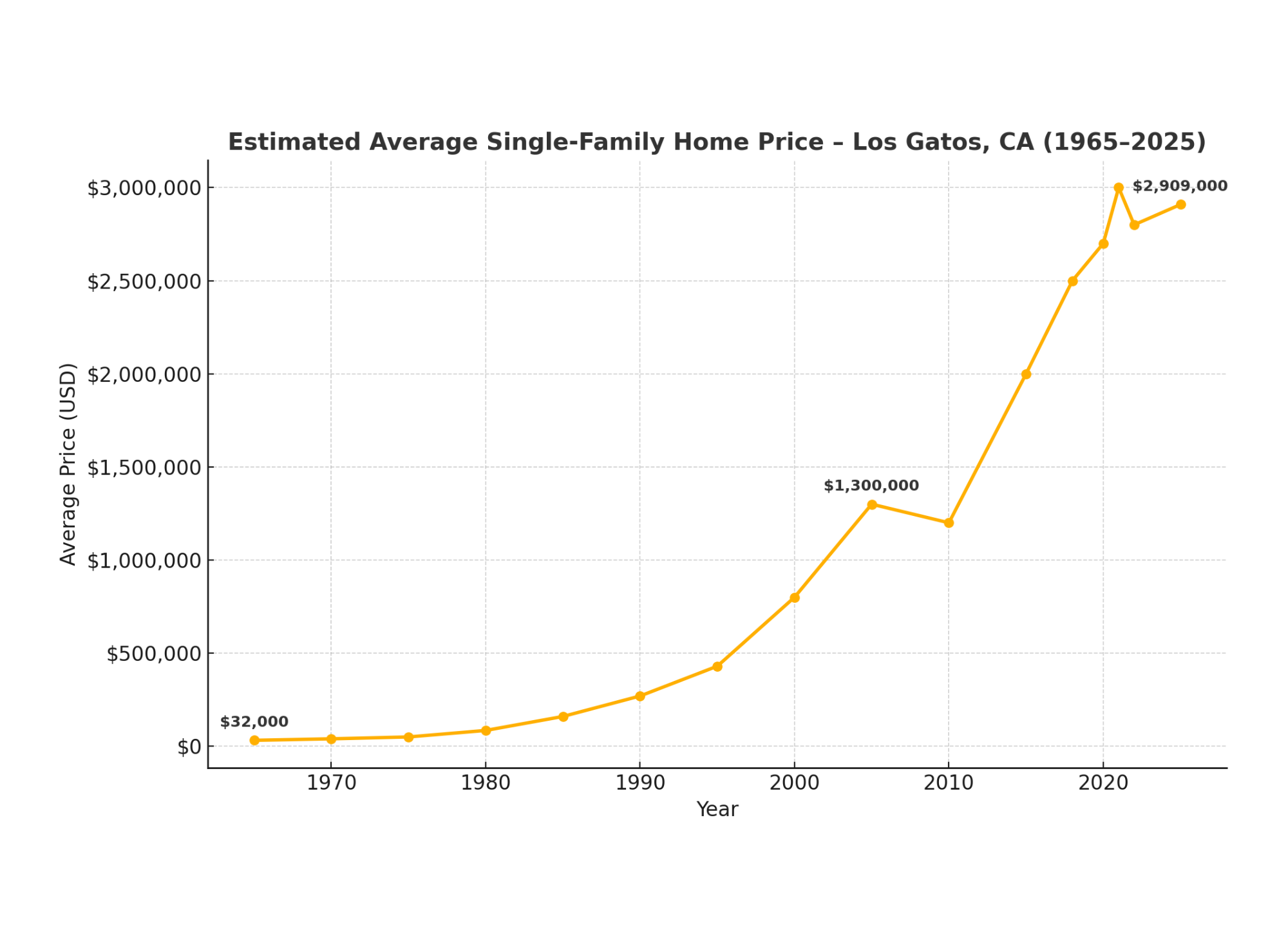

If you invested $32K into Los Gatos Real Estate in 1965, you’d have 8,990% growth (7.81% per year)

If you invested $32K into the S&P 500 in 1965, you’d have 36,600% growth (10.35% per year)

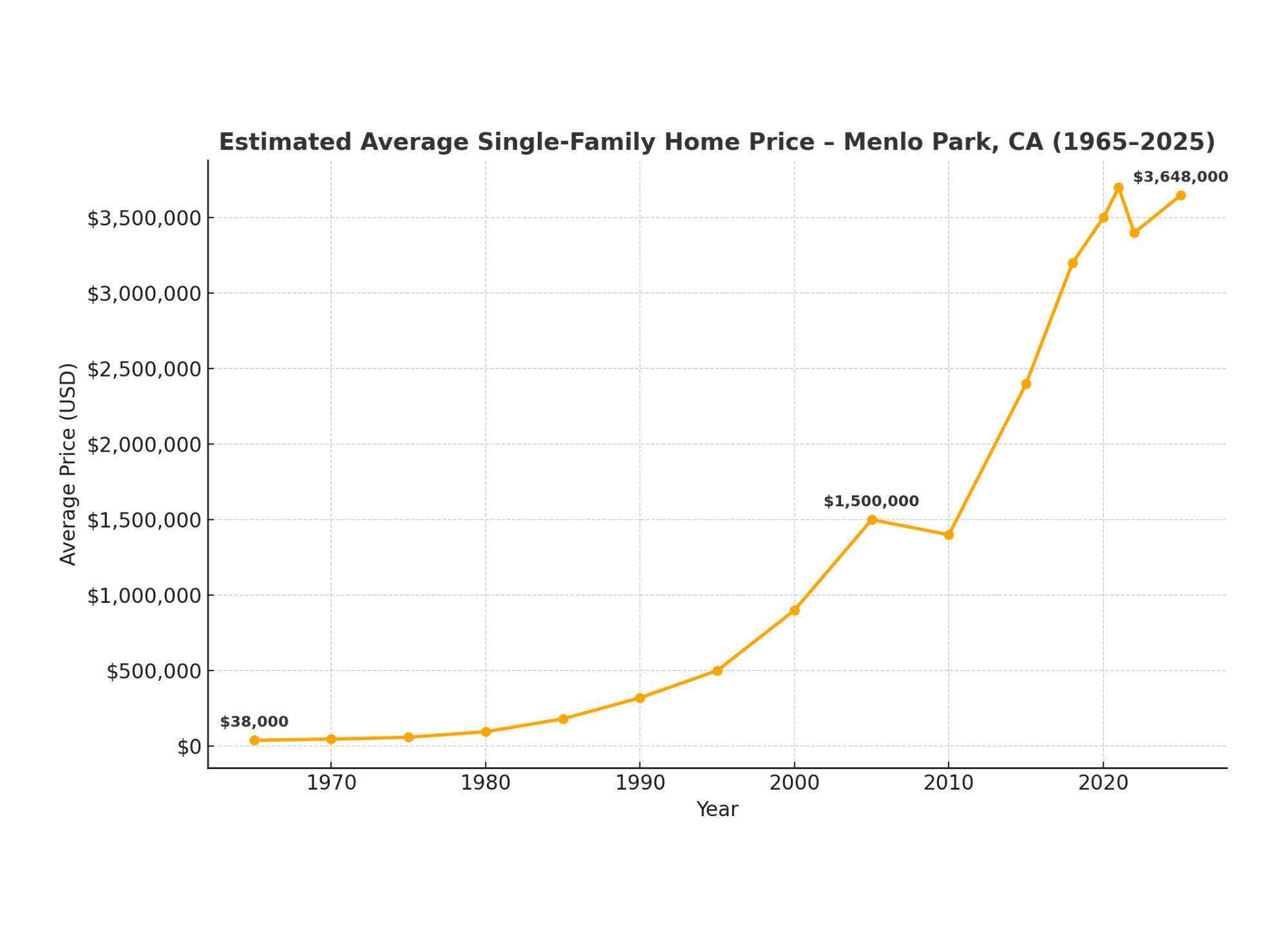

If you invested $38K into Menlo Park Real Estate in 1965, you’d have 9,500% growth (7.90% per year)

If you invested $38K into the S&P 500 in 1965, you’d have 36,600% growth (10.35% per year)

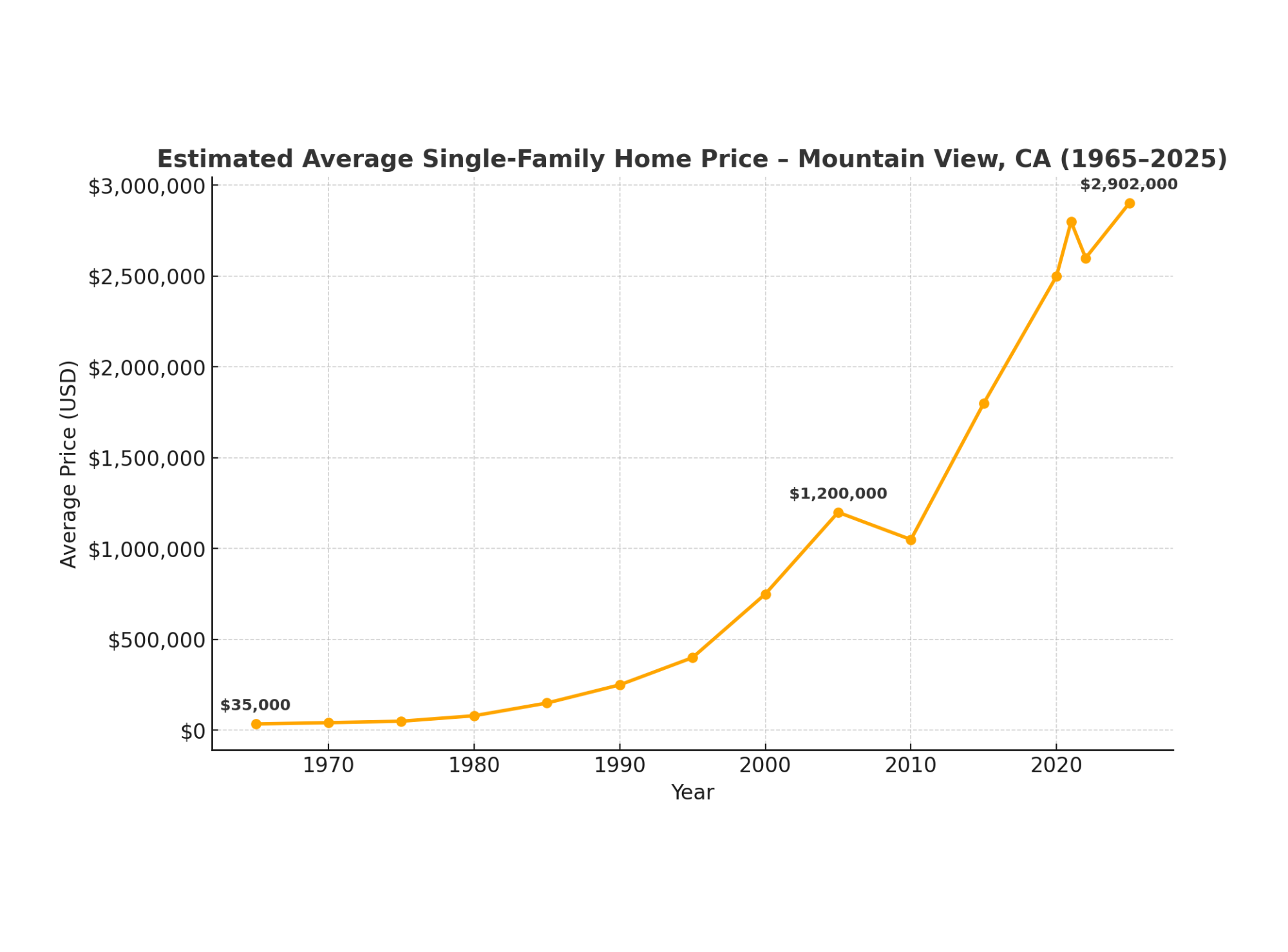

If you invested $35K into Mountain View Real Estate in 1965, you’d have 8,191% growth (7.64% per year)

If you invested $35K into the S&P 500 in 1965, you’d have 36,600% growth (10.35% per year)

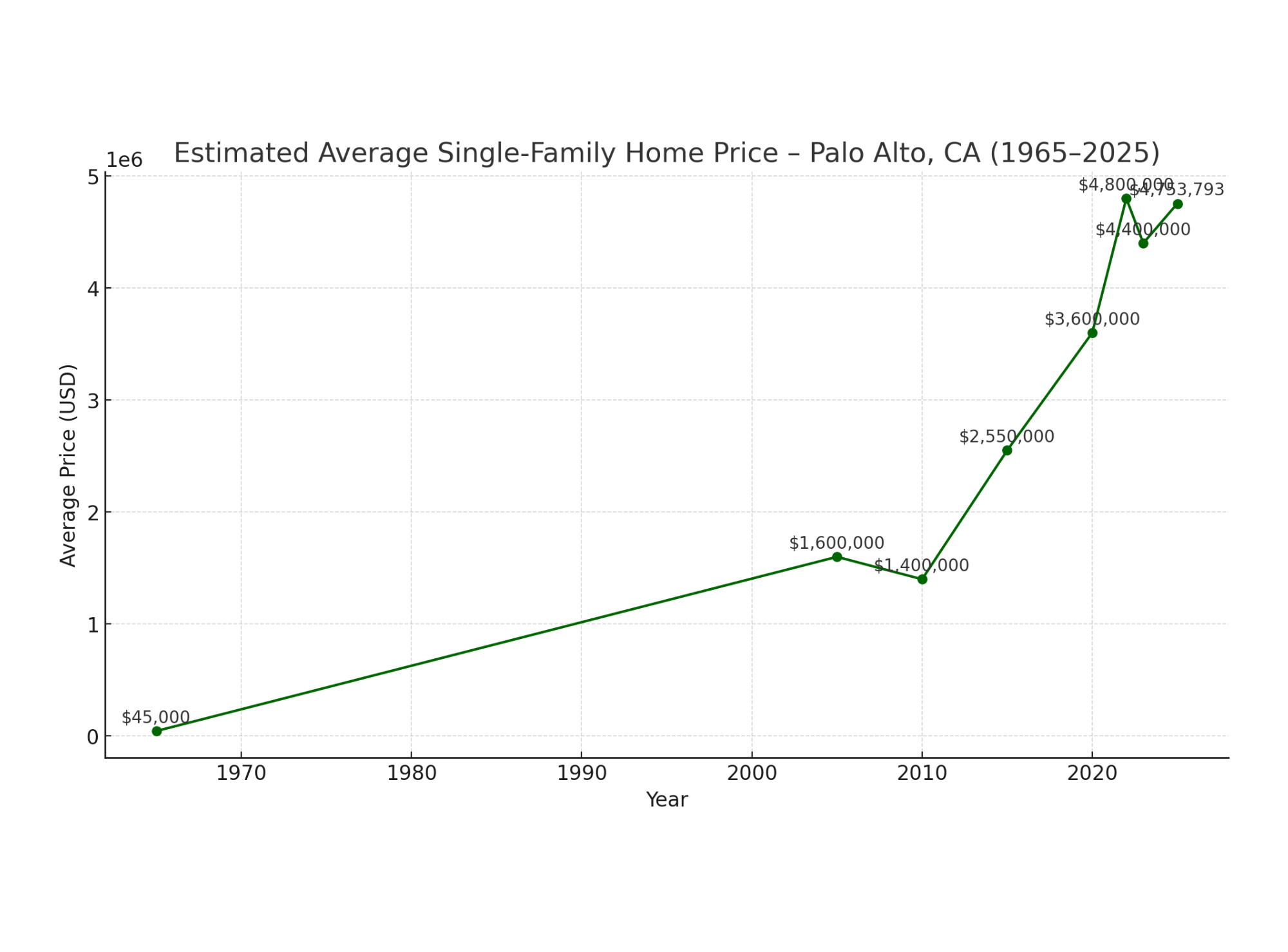

If you invested $45K into Palo Alto Real Estate in 1965, you’d have 10,463.98% growth (8.08% per year)

If you invested $45K into the S&P 500 in 1965, you’d have 36,600% growth (10.35% per year)

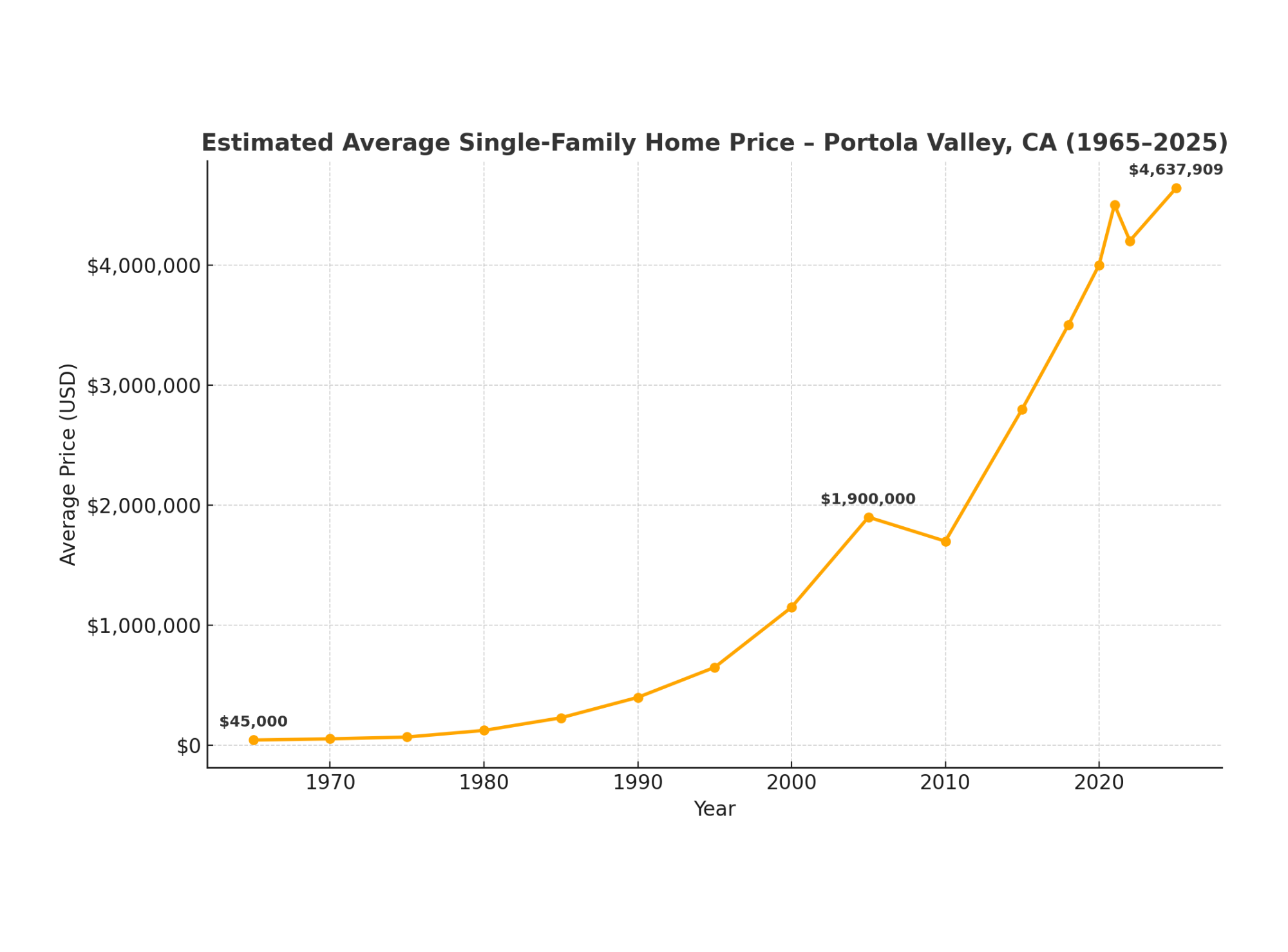

If you invested $45K into Portola Valley Real Estate in 1965, you’d have 10,206% growth (8.03% per year)

If you invested $45K into the S&P 500 in 1965, you’d have 36,600% growth (10.35% per year)

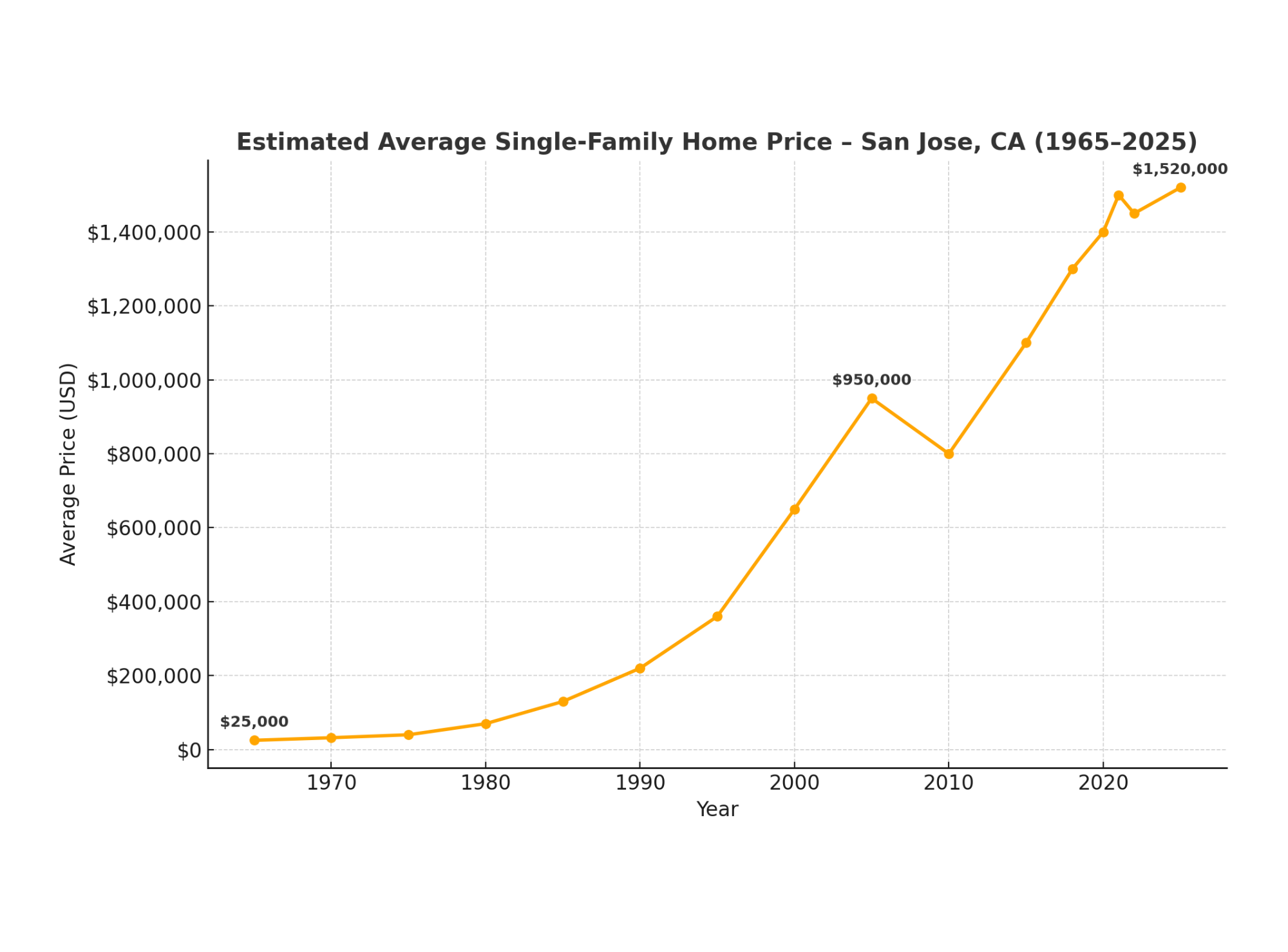

If you invested $25K into San Jose Real Estate in 1965, you’d have 5,980% growth (7.09% per year)

If you invested $25K into the S&P 500 in 1965, you’d have 36,600% growth (10.35% per year)

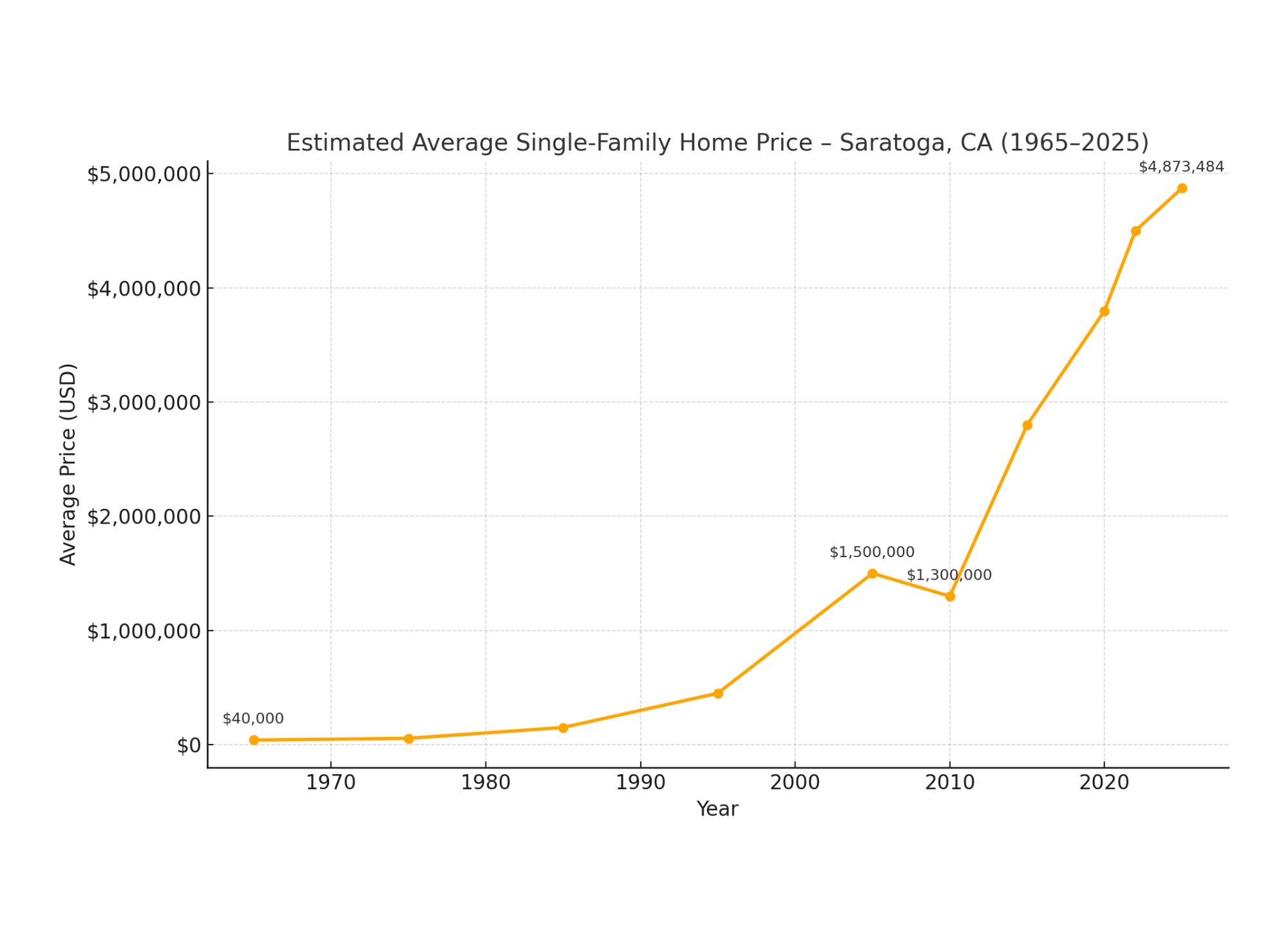

If you invested $40K into Saratoga Real Estate in 1965, you’d have 12,083% growth (8.33% per year)

If you invested $40K into the S&P 500 in 1965, you’d have 36,600% growth (10.35% per year)

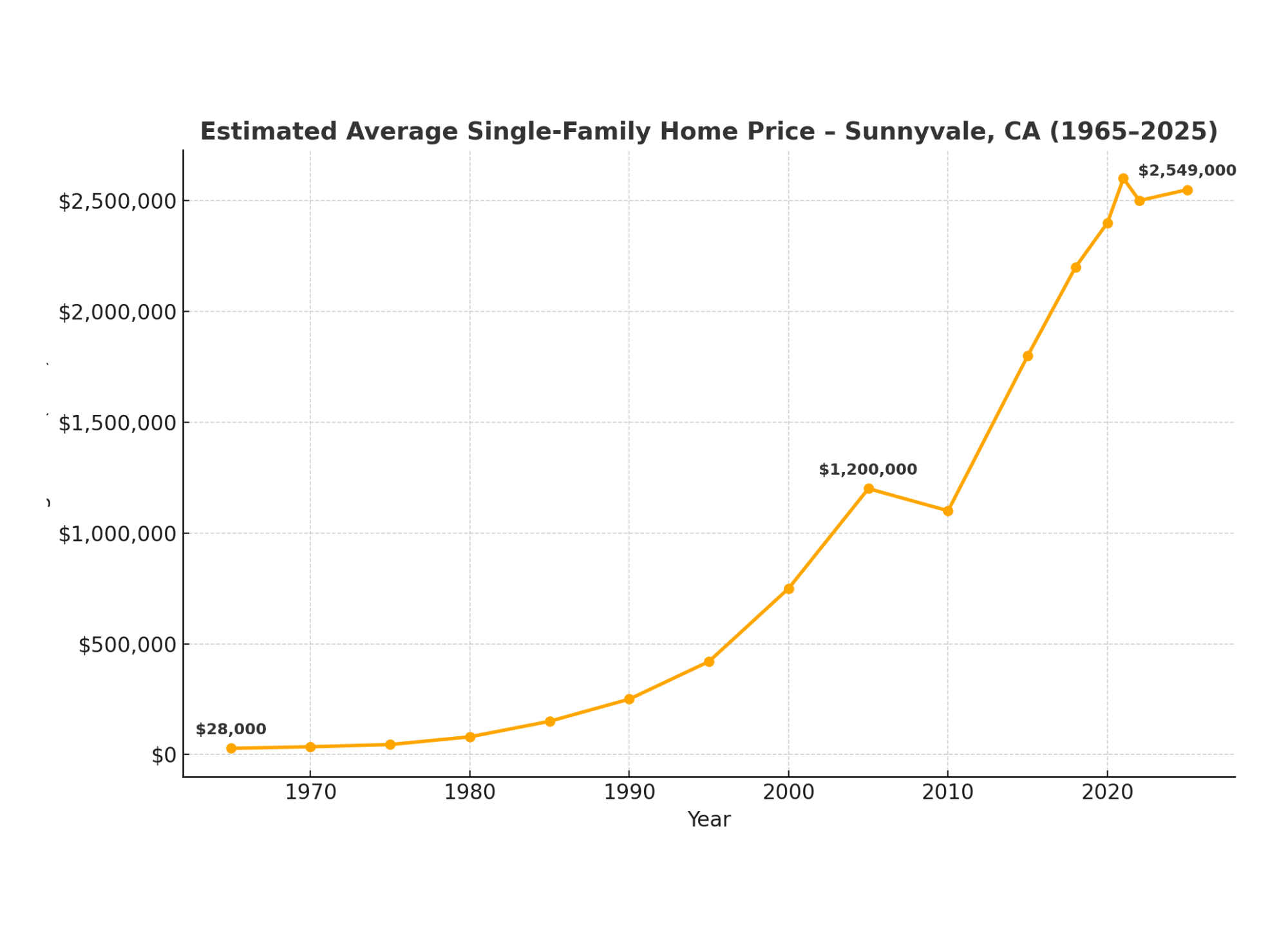

If you invested $28K into Sunnyvale Real Estate in 1965, you’d have 9,003% growth (7.81% per year)

If you invested $28K into the S&P 500 in 1965, you’d have 36,600% growth (10.35% per year)

Graphical Insights

Long Term, Silicon Valley real estate only appreciates.

The appreciation on homes is growing exponentially, A.K.A. the appreciation % is increasing more every year!

The market resilience in this area well outperforms national variance, and is overwhelmingly positive.

Here’s the Thing:

With real estate, you are investing in something you simultaneously get to USE and ENJOY.

With stocks, you are putting money away into a future enjoyment.

MEANING: You are enjoying a product AND increasing your future wealth at the same time!

Why Should That Appreciation Stop?

No Land - What CAN be developed in the Silicon Valley IS developed, limiting supply and increasing value of all properties.

Protecting Beauty - California regulation keeps the surrounding area gorgeous with limiting development, increasing value!

Consistent Industry

Core industry may change,

but industry never leaves Silicon Valley

Agriculture

Military Electronics Boom

Companies like Hewlett Packard and Varian Associates emerge

Silicon Valley Birth

Semiconductors revolutionize electronics, companies like AMD emerge

Personal Computing

Companies like Apple and Intel emerge, while networking software expands with Cisco, Adobe, and Oracle

Internet and Mobile Era

Companies like Google, Facebook, and LinkedIn push industry towards mobile

AI and Deep Tech HUB

Nvidia and OpenAI have disrupted the tech industry and have challenged all others to keep up and expand quickly!